College and Career Planning

Scholarships and Financial Aid

The rising costs of a college education have made the process of applying for and receiving scholarships and financial aid more important than ever before in making a college education an affordable endeavor. Luckily, finding available college scholarships has become easier than ever before due to the information age. Scholarships from corporations, foundations, and sponsors are now searchable from a number of different online sources.

We have provided links to those, as well as sources of local scholarships not found in scholarship search engines. We have also provided guidance on seeking financial aid and outlined what the costs are in today's college education.

Focus on Net Price, Not Sticker Price

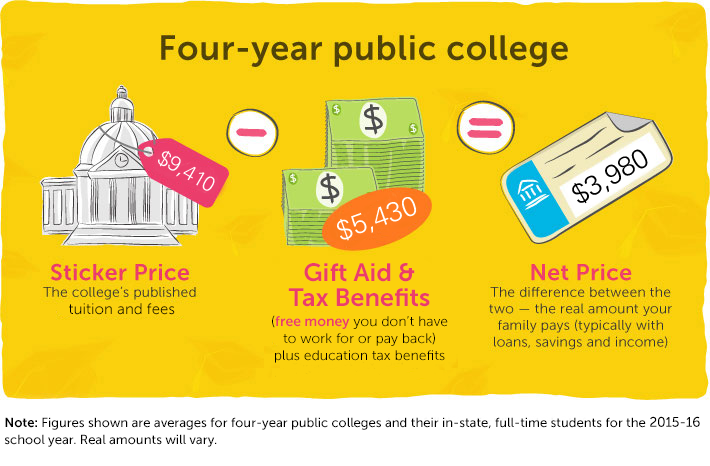

College may seem expensive. But the truth is that most students pay less than their college’s sticker price, or published price, thanks to financial aid. So instead of looking at the published price, concentrate on your net price — the real price you’ll pay for a college. Your net price is a college’s sticker price for tuition and fees minus the grants, scholarships, and education tax benefits you receive. The net price you pay for a particular college is specific to you because it's based on your personal circumstances and the college’s financial aid policies.

The net price, on average, is considerably lower than the published price. For example, the average published in-state price for tuition and fees for four-year public colleges is $9, 410 per year. But the average net price — what the average family really pays — is just $3,980 per year. For private nonprofit four-year colleges, the average published price is $32,410 per year, but the average family pays just $14,890 annually.

Colleges you thought were out of your reach may turn out to be affordable.

What Is a Net Price Calculator?

A net price calculator is a free online tool that gives you a personalized estimate of net price. The federal government now requires most colleges and universities to have a net price calculator on their websites.

How Do Net Price Calculators Work?

A college’s net price calculator asks you questions about your family’s finances and may also ask you questions about your GPA, test scores, activities and other things that may qualify you for financial aid. It uses your answers to figure out how much money in grants and scholarships the college is likely to award you. It then subtracts that number from the full cost of attendance to estimate how much the college might really cost you.

Many net price calculators also provide information about other kinds of financial aid you might be offered. These include loans and work-study jobs.

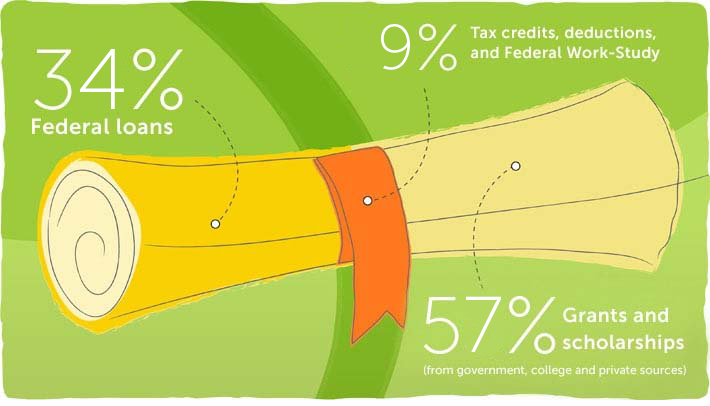

With financial aid, many students who can’t afford the full cost of college are able to earn their degrees. In fact, most full-time college students receive some type of financial aid.

Financial Aid Defined

Financial aid is money that the government and other organizations give you or lend you so you can pay for college. To qualify for financial aid, you have to apply.

Sources of Financial Aid

Financial aid comes from these sources:

- The federal government (the largest source)

- State governments

- Colleges and universities

- Private organizations, such as companies, clubs and religious organizations

- Banks and lending companies

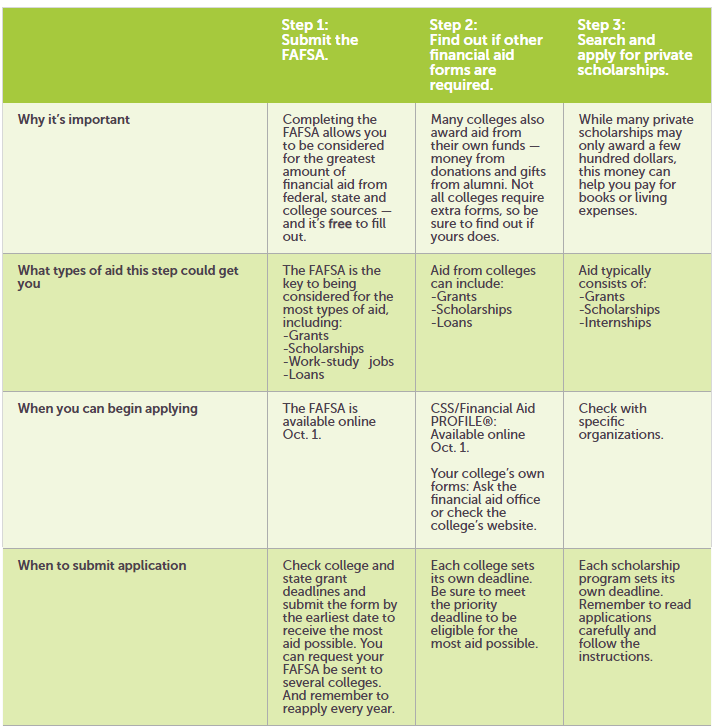

Have you heard your high school counselor or other students reference the FAFSA, and you didn't know what they were talking about? What is FAFSA, and what do you have to know about it? Well, if you're hoping to get financial aid for college, then it's critical that you know about the FAFSA.

FAFSA is an acronym that stands for the Free Application for Federal Student Aid. Colleges and universities use this form to determine your eligibility for federal, state, and college-sponsored financial aid, including grants, educational loans, and work-study programs.

The FAFSA is used by the US Department of Education to calculate your Expected Family Contribution, or EFC, for college. Your EFC is a dollar amount that reflects how much you can afford to pay for college for the following academic year. The lower your EFC, the more aid you're eligible to receive. Your EFC is determined based on income, assets, and other household information you'll be asked to provide on the FAFSA.

Below is a comprehensive video guide on filling out and submitting the FAFSA.

WHAT is the CSS Profile?

The CSS Profile is an online application that collects information used by nearly 400 colleges and scholarship

programs to award non-federal aid. (For federal aid you must complete the FAFSA, available Oct. 1 at fafsa.ed.gov.) Some

colleges may require the CSS Profile from both biological/adoptive parents in cases of divorce or separation.

WHEN do I complete the CSS Profile?

You may complete the CSS Profile as early as Oct. 1, 2022. You should submit no later than two weeks before the EARLIEST priority filing date specified by your colleges.

WHO must complete the CSS Profile?

Check your colleges’ information to determine whether they require the CSS Profile. A list of participating colleges is also found on the CSS Profile Homepage.

HOW do I complete the CSS Profile?

You submit the CSS Profile at cssprofile.org. Once you sign in, you will find a list of useful documents, such as your federal tax returns and other financial information that you’ll need to have at hand to complete the application. Help is provided within the application and additional help is available by chat, phone, or email by clicking “Contact Us” in the application.

WHAT does the CSS Profile Cost?

The fee for the initial application is $25. Additional reports are $16. Payment may be made via credit or debit card. First-time domestic college applicants may receive CSS Profile fee waivers if the student qualified for an SAT fee waiver, or if the student is an orphan or ward of the court under the age of 24, or if their family's adjusted gross income is $100,000 or less.

Read the FULL 2022-2023 CSS Profile Student Guide by clicking HERE.

Scholarship Search

In years past, the number of scholarships that any student could reasonably apply were limited to those that were in their local area, were in nationally published guides, or that were passed by word of mouth. Today, the era of the internet has spawned multiple free resources to search for thousands of general and specialized scholarships.

In addition to the scholarship search engines listed below, you can also find scholarships using these free sources:

- the financial aid office at a college or career school

- Dr. Pam Rambo

- the U.S. Department of Labor’s FREE scholarship search tool

- federal agencies

- your state grant agency

- WJCC or local library’s reference section

- foundations, religious or community organizations, local businesses, or civic groups (see Local Scholarships below for some examples)

- organizations (including professional associations) related to your field of interest

- ethnicity-based organizations

- your employer or your parents’ employers

Scholarship Search Sites

There are more than a few college scholarship search sites on the internet. We have listed the four most commonly used below. The one aspect of them all, and which should be true for ANY college scholarship search site, is that it is FREE. You should NOT have to pay to access college scholarship listings with the number of free sites out there. Note that most sites WILL ask you to register with them, and you may opt-out of receiving any additional communications from them if you wish.

How do I get my scholarship money?

That depends on the scholarship. The money might go directly to your college, where it will be applied to any tuition, fees, or other amounts you owe, and then any leftover funds given to you. Or it might be sent directly to you in a check. The scholarship provider should tell you what to expect when it informs you that you’ve been awarded the scholarship. If not, make sure to ask.

How does a scholarship affect my other student aid?

A scholarship will affect your other student aid because all your student aid added together can’t be more than your cost of attendance at your college or career school. So, you’ll need to let your school know if you’ve been awarded a scholarship so that the financial aid office can subtract that amount from your cost of attendance (and from certain other aid, such as loans, that you might have been offered). Then, any amount left can be covered by other financial aid for which you’re eligible. Questions? Ask your financial aid office.

Local Scholarships

Click on any of the links below to be taken to information specific to the listed scholarship:

Coca Cola Scholarship ($20,000/yr)

Pursuing a Positive Impact Scholarship ($3,000/yr)

Williamsburg Rotary Scholarship Fund ($1,000/yr)

Hampton Roads Orthopaedics & Sports Medicine Award ($1000)

The Colonial Italian American Organization Foundation 2018 Scholarship Program ($1,000)

JWCW Nan and Pete Cruikshank Scholarship ($1,000)

The Auxiliary of the Sentara Williamsburg Regional Medical Center Scholarship

Jim Robertson Scholarship ( JC Ruritan Club)

Caring.com Scholarship (up to $1,500, plus access to other Student Caregiver scholarships)

Williamsburg Players Scholarship ($2000)

Williamsburg Women's Chorus Scholarship ($300)

Cooper-Hurley Distracted Driver Awareness Scholarship ($2,000)

Virginia Sports Hall of Fame Annual Student Athlete Achievement Awards ($1,000)

Additional Scholarship Search Engines

CFG Scholar Bank (substantial group listing of scholarships, free, no registration required)

Do you know about a scholarship we can list here? Please fill in and submit details in the form below: